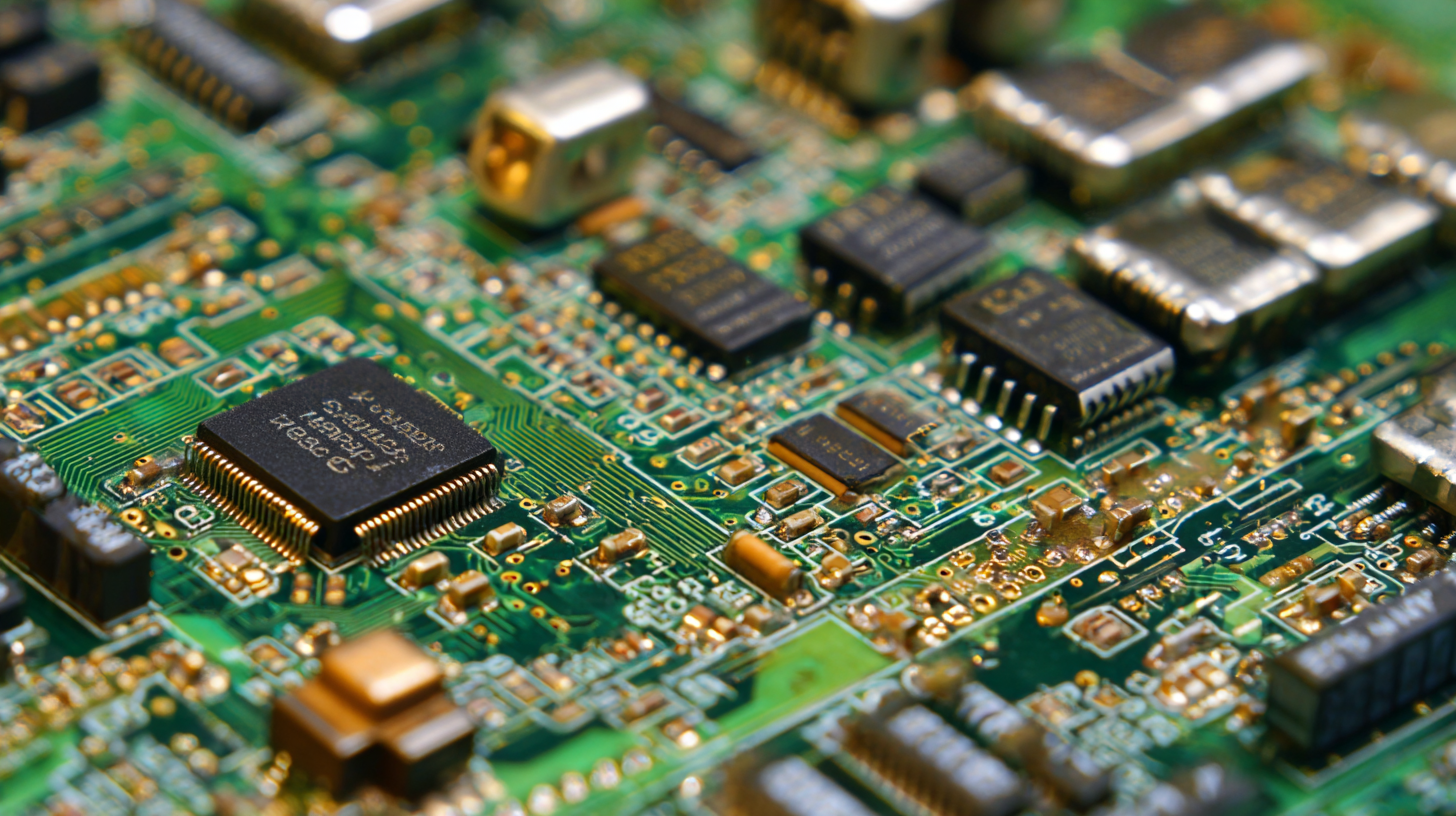

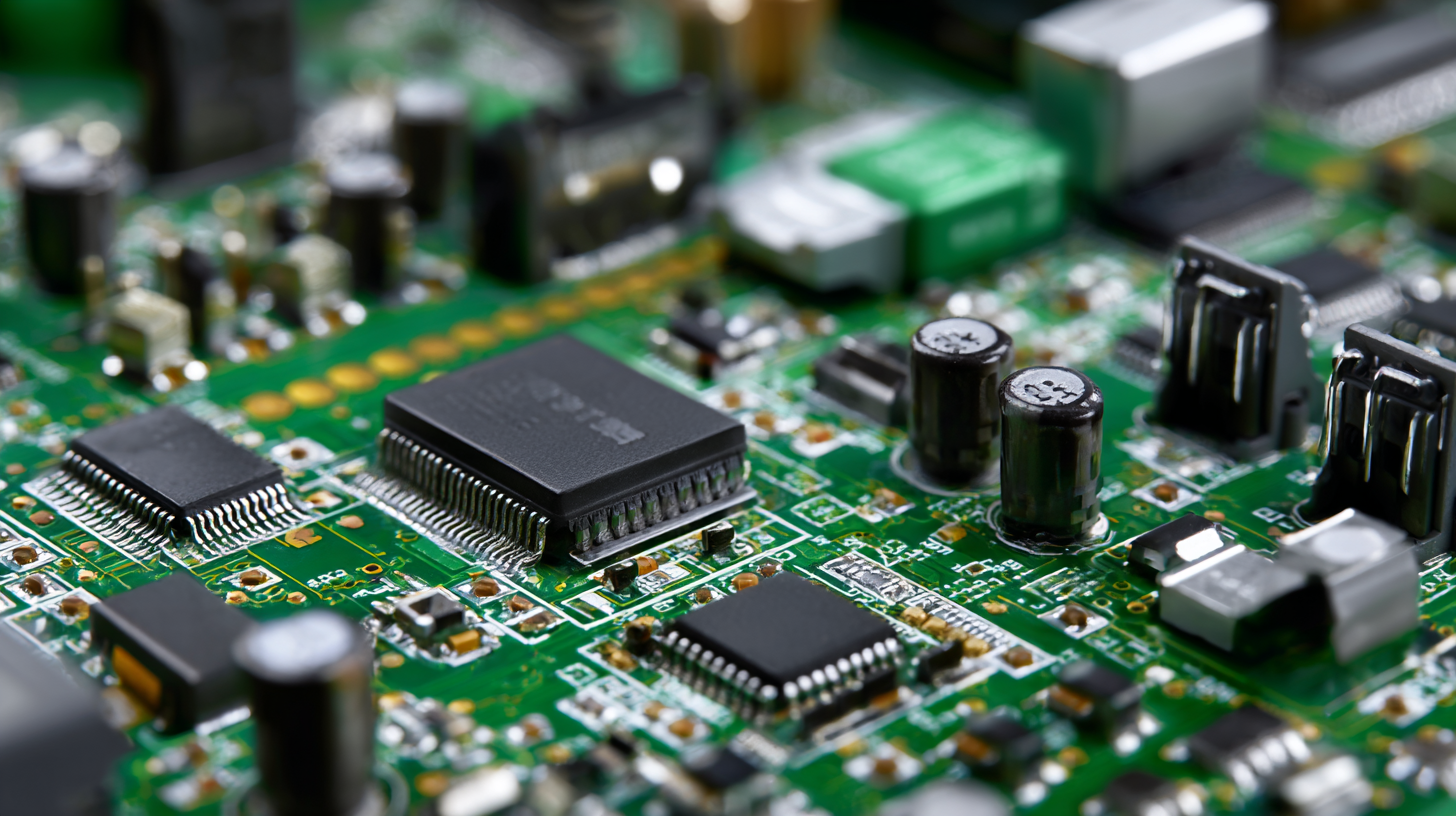

In the fast-evolving landscape of electronics, the demand for high-quality printed circuit board assembly (PCBA) continues to surge, driven by innovations in consumer electronics, automotive, and medical devices. According to a recent market report by Grand View Research, the global PCB market is expected to reach USD 113.0 billion by 2027, growing at a CAGR of 4.2%. As a crucial component in virtually all electronic devices, efficient and reliable PCBA processes are essential for manufacturers aiming to stay competitive on a global scale.

China's manufacturing power, recognized for its advanced capabilities and cost-effectiveness, offers tremendous potential for businesses seeking to optimize their supply chains. This blog will delve into top strategies for leveraging China's PCBA capabilities, equipping global buyers with insights to make informed decisions in their sourcing processes.

China’s PCB assembly industry has emerged as a powerhouse, characterized by its advanced manufacturing capabilities and competitive pricing. With a vast network of suppliers and a workforce skilled in cutting-edge technology, Chinese manufacturers offer an extensive array of printed circuit board (PCB) assemblies tailored to meet the diverse needs of global buyers. This unique blend of resources and expertise enables companies to produce high-quality products while maintaining efficiency in production timelines.

The landscape of China’s PCB assembly sector is continuously evolving, driven by innovations in technology and growing demand for electronic devices. As industries across the globe increasingly rely on intricate electronic systems, the importance of reliable and high-performance PCB assembly cannot be overstated. Suppliers in China are not only ramping up their production capacities but are also embracing automation and smart manufacturing practices to enhance quality control and reduce lead times. This proactive approach positions them favorably in the global market, presenting exciting opportunities for international buyers looking to leverage China's manufacturing prowess.

This chart illustrates the production volumes of different types of printed circuit boards (PCBs) in China, highlighting the leading sectors in the PCB assembly industry.

China's manufacturing prowess is reshaping the global landscape of the

printed circuit board (PCB) industry.

With the global PCB market valued at $69.69 billion

in 2023, and poised to reach $113.49 billion

by 2032, China's strategic focus on innovation and infrastructure presents an immense opportunity

for international buyers. Key factors driving this success include significant investments

in advanced manufacturing technologies, such as automation and smart factory solutions,

which enhance production efficiency and quality.

The evolution towards smart manufacturing is not instantaneous; it requires deliberate planning

and execution. Leading manufacturers in China are steadily upgrading their facilities to integrate

intelligent systems that streamline operations. This transformation is critical as it positions

China as a competitive player in a market increasingly driven by technological advancements.

Understanding these dynamics

will allow global buyers to align their sourcing strategies with the capabilities of Chinese PCB

manufacturers, ultimately leveraging their strengths for mutual benefit in a rapidly expanding marketplace.

In today's fast-paced technological landscape, the demand for high-quality printed circuit boards (PCBs) has surged, making efficient manufacturing processes more critical than ever. Innovations in PCB assembly are at the forefront of enhancing production efficiency, enabling manufacturers to meet the rigorous demands of global buyers. Techniques such as automated pick-and-place systems have revolutionized how components are affixed to PCBs, significantly reducing assembly time and minimizing the likelihood of human error.

Moreover, advancements in materials and design software are streamlining the entire PCB production process. The integration of AI-driven analytics allows manufacturers to optimize layouts and identify potential issues before they escalate. By leveraging these cutting-edge technologies, China's manufacturing power is not only keeping pace with international standards but is also setting new benchmarks in the industry. As global buyers seek reliable partners for their PCB needs, those that harness these innovations will undoubtedly lead the charge in meeting the evolving requirements of the market.

Navigating the complex landscape of global supply chains has become increasingly critical for buyers seeking high-quality printed circuit board assemblies (PCBAs). As companies operate in a highly interconnected world, the ability to leverage China’s exceptional manufacturing capabilities offers a distinct advantage. Chinese manufacturers not only provide advanced technology and competitive pricing but also boast a robust infrastructure that supports swift production cycles. This dynamic enables global buyers to optimize their supply strategies and meet market demands more effectively.

Navigating the complex landscape of global supply chains has become increasingly critical for buyers seeking high-quality printed circuit board assemblies (PCBAs). As companies operate in a highly interconnected world, the ability to leverage China’s exceptional manufacturing capabilities offers a distinct advantage. Chinese manufacturers not only provide advanced technology and competitive pricing but also boast a robust infrastructure that supports swift production cycles. This dynamic enables global buyers to optimize their supply strategies and meet market demands more effectively.

Moreover, the rise of digital tools and platforms has simplified sourcing processes, allowing buyers to connect directly with manufacturers. Enhanced transparency and communication enable better collaboration, ensuring that quality standards are met and timelines adhered to. As the demand for PCBA continues to surge in sectors such as consumer electronics and automotive, understanding how to navigate these supply chains becomes essential. Embracing the opportunities presented by China’s manufacturing prowess can lead to significant cost savings and improved product offerings, positioning buyers for success in a fast-paced global market.

In recent years, China's printed circuit board (PCB) market has witnessed transformative changes driven by advanced packaging technologies and increasing global demand. Innovations like CoWoS (Chip-on-Wafer-on-Substrate) are reshaping the landscape, prompting many manufacturers to explore the potential of new packaging solutions. However, skepticism remains among PCB makers regarding the sustainability of these trends. While some reports from industry analysts claim that the rapid adoption of these technologies is inevitable, the industry's veterans remind us that overhyped trends can often lead to misplaced investments and uncertainty.

Amid these discussions, companies with a solid track record continue to leverage their strengths in manufacturing capabilities and quality assurance. For instance, established players in the PCB industry have built reputations based on consistency and reliability, crucial factors for global buyers. As market dynamics evolve, these manufacturers are well-positioned to adapt and thrive, providing high-quality products while navigating the complexities introduced by emerging technologies. Indeed, the future of PCB manufacturing in China hinges on the ability to balance innovation with proven practices, ensuring they meet the escalating requirements of a global marketplace.

| Parameter | Data |

|---|---|

| Total PCB Production (2023) | 30 billion units |

| Growth Rate (2020-2023) | 8.5% |

| Export Volume (2023) | 15 billion units |

| Key Markets for Exports | USA, Europe, Japan |

| Trend: Automation in PCB Manufacturing | Increasing adoption by 15% annually |

| R&D Investment in PCB Technology | $1.2 billion (2023) |

| Sustainability Initiatives | 50% reduction in waste by 2025 |

| Market Share of Leading PCB Manufacturers | 60% (combined) |

Address :

Absolute Electronics Services LLC

330 W Fay Ave

Addison, IL – 60101

2025 Absolute Electronics Services, All Rights Reserved